On June 10, the digital currency Bitcoin lost 30% of its value in a few hours, dropping from US $28.92 to $20.01 per coin. Bitcoins are a largely untraceable form of money, relying on a peer-to-peer system for legitimacy, instead of a central authority like a government or Second Life's Linden Labs. Gawker recently brought Bitcoins to mainstream attention in a report on Silk Road, a website where aspiring drug users can use the anonymous currency to purchase home delivery of any psychoactive from LSD to cocaine.

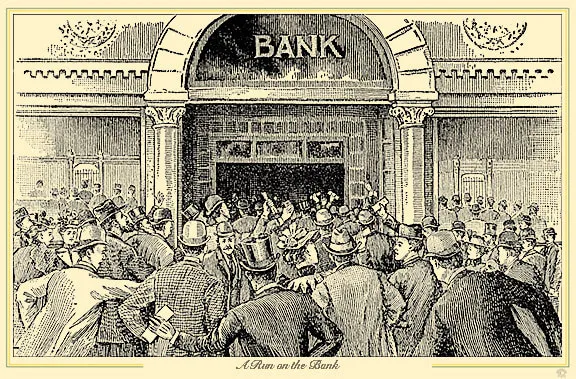

The Bitcoin Black Friday was the result of certain events that real life markets have learned to control for - a bank rush, where Bitcoin owners exchanged their Bits back to bucks en masse, and a market that stayed open despite rapid inflation over the last few weeks. Millions of dollars in Bitcoin investments were lost in the resulting crash. This fast-moving bear market goes to show that online events increasingly mimic 'real' events, and that the investors in digital markets could stand to crack open their history books. Virtual economies work the same as actual ones, although all money, by definition, is already virtual.

Comments (0)

Share your thoughts and join the technology debate!

No comments yet

Be the first to share your thoughts!